income tax malaysia 2018 calculator

An annuity is a long-term agreement contract between you and an insurance company that allows you accumulate funds on a tax-deferred basis for later payout in the form of a guaranteed income. HR Block employees including Tax Professionals are excluded from participating.

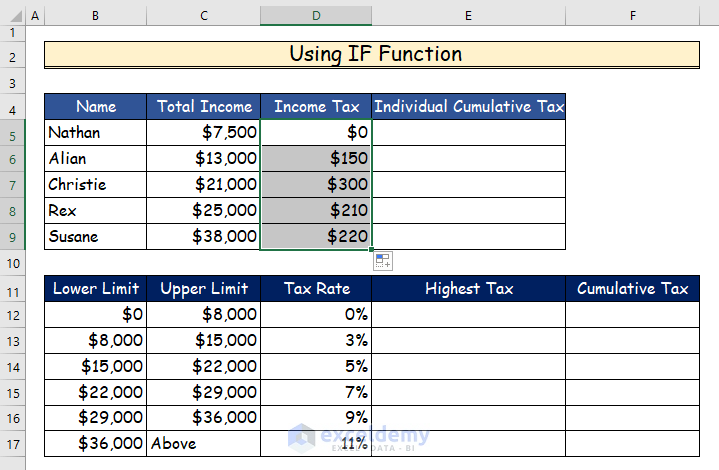

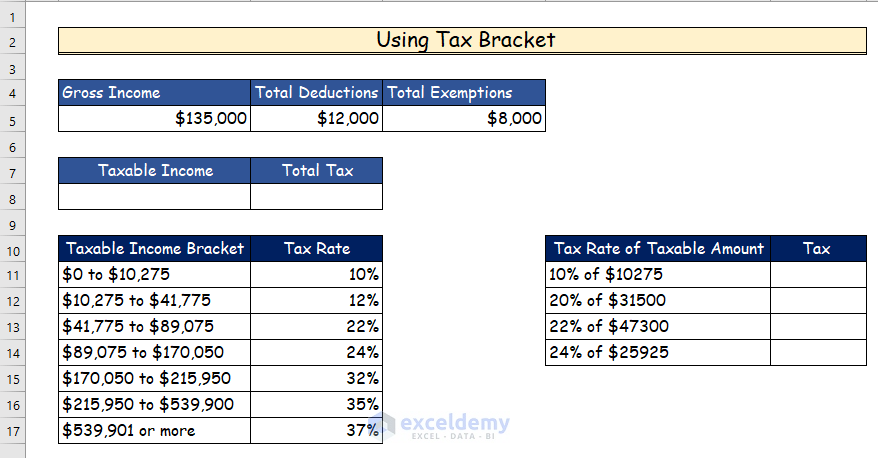

Income Tax Computation In Excel Format 4 Suitable Solutions

Easily calculate your tax.

. If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor state purchase price paid. I will be returning to Thailand from ireland In 2018 I spent 4 months in ireland 2019 7 months 2020 7 months and it looks. This is because the correct amount.

United States Sales Tax. And now Malaysia and Chile are joining their ranks with important lessons for other developing countries navigating an increasingly deglobalised world. Thanks for the update on the tax rates.

Based on the income tax slab an individual falls into they do their maximum tax saving. To amend a return for 2018 or earlier youll need to print the completed Form 1040-X and any other forms youre amending. However every section amongst these has a pre-set maximum investment amount.

Taxation on gains within Australian Superannuation Funds. Counties cities and districts impose their own local taxes. What is B40 M40 and T20.

According to the budget released in 2019 there have been some changes in the structure of the tax slab in the interim budget 2019 the tax rebate of Rs. Referred client must have taxes prepared by 4102018. TurboTax Online Free Edition customers are entitled to payment of 30.

Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018. The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D. 1961 is available to the individuals who have a yearly income up to Rs.

Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. 7 areas in Klang Valley affordable for middle-income earners. Employees Provident Fund Malaysia Pensions in.

I have closed my tax file in Malaysia when I relocated to Thailand. Italy Jamaica Japan Kazakhstan Kenya Kosovo Laos Latvia Liberia Liechtenstein Lithuania Luxembourg Macedonia Madagascar Malawi Malaysia Maldives Malta Mauritius Middle East Region Middle East Bahrain Egypt Iraq Jordan Kuwait. Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income.

Say for example the year starting from 1st April 2018 and ending on 31st March 2019 is the assessment year 2018-19 the previous year would be 2017-18. As of 1 July 2018 members have also been able to withdraw voluntary contributions made as part of the First Home Super Saver Scheme FHSS. The rates of assessment year are taken into consideration.

I have updated the income tax calculator for Thailand I hope it helps your users. Here is the latest income tax slabs and income tax rates for FY 2021-22 and FY 2022-23. In 1990 per capita income levels were lower in Malaysia and Chile than in Mexico.

B40 M40 and T20 Malaysia refer to the household. How to start where to check the latest price of gold. Estimate your personal income taxes in each province and territory with our Income Tax Calculator for Individuals.

Estimate your tax refund and where you stand Get started. The income tax slab and rates for FY 2021-22 is important as it is needed to calculate income tax amount while filing ITR this year and the income tax slabs and rates for FY 2022-23 is need to know how much tax-saving investments you need to do to reduce your tax outgo. 12500 under Section 87A of IT Act.

A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. My support is about THB. All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018.

PAYE became a Final Withholding Tax on 1st January 2013. Available at participating offices and if your employers participate in the W-2 Early AccessSM program. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight.

The income tax calculator is available for quick and easy access to basic tax calculation for the public. Calculate United States Sales Tax. Income Tax Slab Rates for FY 2019-20 AY 2020-21.

Hong Kong Singapore South Korea and Taiwan. Available at participating offices and if your employers participate in the W-2 Early AccessSM program. So did the so-called Asian tigers.

HR Block employees including Tax Professionals are excluded from participating. Referred client must have taxes prepared by 4102018. What is the average income in Malaysia.

Sales Tax in US varies by location. There is base sales tax by most of the states. This maximum investment amount is decided by the government.

Under the US-Australia Income Tax Treaty there is an opportunity to lawfully avoid US. Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers. As of 2019 the average income in Malaysia is RM7901.

Maximum Refund Guarantee Maximum Tax Savings Guarantee - or Your Money Back. See California Texas Florida New York Pennsylvania etc. SEE WHAT OTHERS ARE READING.

Japan avoided it. As a result most employees will not be required to lodge Form S returns. Online is defined as an individual income tax DIY return non-preparer.

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Salary Calculator Career Resources

Best Tax Software In Canada In 2022 Hostingcanada Org

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Cukai Pendapatan How To File Income Tax In Malaysia

A Message From Sharp S Calculator From 41 Years Ago Sharp Blog

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Accounting Finance Western Piedmont Community College

Recommended Budget Percentages How Much Should You Spend Nasdaq

Income Tax Collection Vital For The Malaysia We Love

How Is Taxable Income Calculated How To Calculate Tax Liability

How They Do It Corporations Craziest Tax Strategies And How You Can Compete

Income Tax Computation In Excel Format 4 Suitable Solutions

How Is Taxable Income Calculated How To Calculate Tax Liability

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

No comments for "income tax malaysia 2018 calculator"

Post a Comment